Technology

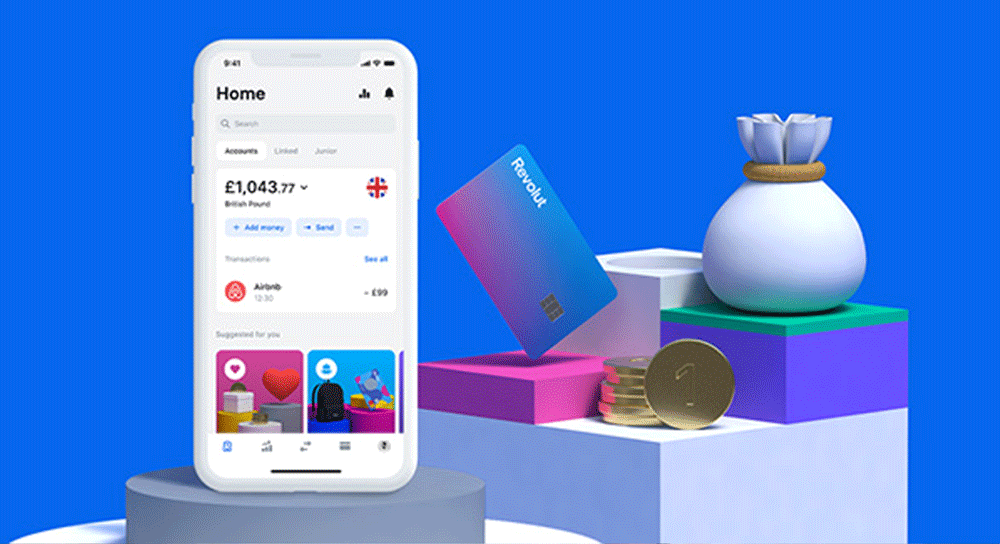

Revolut Review : Must Read Before Opening Account

About Revolut

Revolut is a digital banking and financial technology company that provides various financial services to individuals and businesses. Here is an overview of Revolut:

- Banking Services: Revolut offers a range of banking services, including current accounts, currency exchange, and international money transfers. Users can hold and manage multiple currencies within a single account, making it convenient for international transactions.

- Mobile App: Revolut operates primarily through its mobile app, which is available for iOS and Android devices. The app provides a user-friendly interface for managing finances, making payments, and accessing various features and services.

- Currency Exchange: One of Revolut’s notable features is its competitive currency exchange rates. Users can exchange currencies within the app at real-time rates, saving on foreign exchange fees compared to traditional banks.

- Money Transfers: Revolut allows users to send and receive money domestically and internationally, with the ability to make transfers in multiple currencies. Transfers can be done quickly and conveniently through the app.

- Debit Card: Revolut offers a prepaid debit card that can be used for purchases and ATM withdrawals. The card is linked to the user’s Revolut account and supports spending in multiple currencies, making it useful for travelers or those who frequently make international payments.

- Additional Features: Revolut provides various additional features, including budgeting tools, spending analytics, cryptocurrency trading, insurance products, and access to exclusive perks and offers through its premium plans.

- Security: Revolut emphasizes security and employs measures such as two-factor authentication, transaction alerts, and the ability to freeze or unfreeze your card instantly through the app.

- Premium Plans: Revolut offers premium subscription plans, such as Revolut Premium and Revolut Metal, which provide enhanced features and benefits for a monthly fee.

Pros and Cons

Here are some pros and cons of using Revolut:

Pros:

- Convenient and User-Friendly: Revolut offers a user-friendly mobile app interface that makes it easy to manage your finances, make payments, and access various banking services on the go.

- Currency Exchange and International Transfers: Revolut provides competitive exchange rates for currency conversions and allows users to make international money transfers with ease, saving on fees compared to traditional banks.

- Multi-Currency Accounts: With Revolut, you can hold and manage multiple currencies within a single account, making it convenient for individuals who frequently travel or make international transactions.

- Budgeting and Spending Analytics: Revolut offers budgeting tools and spending analytics that help users track their expenses, set savings goals, and gain insights into their spending habits.

- Cryptocurrency Support: Revolut allows users to buy, sell, and hold various cryptocurrencies within the app, making it a convenient platform for cryptocurrency enthusiasts.

- Security Features: Revolut prioritizes security and implements measures such as two-factor authentication, transaction alerts, and the ability to freeze or unfreeze your card instantly through the app.

Cons:

- Limited Customer Support: Some users have reported difficulties in reaching customer support or delays in receiving responses to inquiries, which can be frustrating when assistance is needed.

- Restricted Services in Some Countries: While Revolut has expanded its services to many countries, there are still regions where certain features or services may not be available.

- Limited Account Types for Businesses: Revolut’s business accounts have fewer features and limitations compared to personal accounts, which may not meet the specific needs of all types of businesses.

- Fees for Certain Services: While Revolut offers many free services, there are fees associated with some features, such as currency exchange transactions above certain limits or premium subscription plans for enhanced benefits.

- Less Established than Traditional Banks: Revolut is a relatively new player in the banking industry compared to established banks. This may cause some users to question its stability and long-term viability.

Revolut Account

A Revolut account is a digital banking account provided by Revolut, a financial technology company. Here are some key points about a Revolut account:

Mobile App: Revolut operates primarily through its mobile app, which is available for iOS and Android devices. You can download the app, sign up for an account, and access various banking services directly from your smartphone.

Account Types: Revolut offers different types of accounts, including personal accounts, business accounts, and junior accounts. Each account type comes with specific features and benefits tailored to different needs.

Currency Options: One of the notable features of a Revolut account is the ability to hold and manage multiple currencies within a single account. You can exchange currencies at competitive rates, and the account supports spending and transfers in multiple currencies.

Money Transfers: With a Revolut account, you can send and receive money domestically and internationally. Revolut offers fast and convenient money transfer services, including the ability to make transfers in multiple currencies.

Debit Card: When you open a Revolut account, you have the option to order a physical debit card linked to your account. The card can be used for purchases online and at physical stores, as well as for ATM withdrawals.

Budgeting and Analytics: Revolut provides budgeting tools and spending analytics within the app, allowing you to track your expenses, set budgets, and gain insights into your financial habits.

Additional Features: Revolut offers various additional features, including cryptocurrency trading, savings accounts, insurance products, and access to premium plans with enhanced benefits and features.

Security: Revolut emphasizes security and implements measures such as two-factor authentication, transaction alerts, and the ability to freeze or unfreeze your card instantly through the app.

Revolut Savings Vault

The Revolut Savings Vault is a feature offered by Revolut that allows users to set aside money and save towards specific financial goals. Here are some key points about the Revolut Savings Vault:

- Purpose: The Savings Vault is designed to help users save money for specific purposes or goals, such as a vacation, a down payment on a house, or an emergency fund. It provides a dedicated space within your Revolut account to keep your savings separate from your everyday spending.

- Easy Setup: Creating a Savings Vault is simple and can be done directly through the Revolut app. You can give your Savings Vault a name and set a savings goal amount.

- Auto-Savings: Revolut offers an auto-savings feature that allows you to set up recurring transfers from your main account to your Savings Vault. You can choose the frequency and amount of these transfers, making it easy to automate your savings.

- Round-Up Savings: Revolut also offers a round-up feature where it automatically rounds up your transactions to the nearest whole number and transfers the spare change into your Savings Vault. This helps you save without even thinking about it.

- Interest Rates: Depending on your location, Revolut may offer interest on the money you save in your Savings Vault. The interest rates and terms may vary, so it’s important to check the details specific to your region.

- Flexibility: You can access the money in your Savings Vault at any time. It’s not locked or restricted, allowing you to withdraw the funds whenever you need them. However, keeping your savings separate from your everyday spending can help you stay focused on your financial goals.

- Security: Revolut places a strong emphasis on security and implements measures such as two-factor authentication, transaction alerts, and the ability to freeze or unfreeze your card instantly through the app. Your savings in the Vault are protected along with the rest of your Revolut account.

How Revolut Works in the US

Revolut is a digital banking and financial technology company that operates in the United States, offering various financial services to its customers.

Here’s how Revolut works in the US:

- Sign-up: To get started with Revolut in the US, you need to download the Revolut app from the App Store (for iOS) or Google Play Store (for Android). You can then sign up for an account directly within the app by providing the required information and completing the verification process.

- Account Setup: Once you’ve signed up, you’ll need to set up your Revolut account. This involves linking a bank account to your Revolut account for funding and withdrawals, as well as setting up your preferred security features like two-factor authentication.

- Virtual Debit Card: Upon successful account setup, Revolut provides you with a virtual debit card that you can use for online purchases and payments. The virtual card details can be found in the app, and it can be used immediately for online transactions.

- Physical Debit Card: You also have the option to order a physical Revolut debit card, which can be used for in-person purchases at retail locations and to withdraw cash from ATMs. The physical card is linked to your Revolut account and can be managed through the app.

- Banking Services: Revolut offers various banking services in the US, including currency exchange, international money transfers, bill payments, budgeting tools, and spending analytics. You can manage these services and track your transactions through the Revolut app.

- Additional Features: Revolut may offer additional features in the US, such as the ability to buy, sell, and hold cryptocurrencies, access to premium subscription plans for enhanced benefits, and integration with other financial services or apps.

- Security: Revolut prioritizes security and employs measures like two-factor authentication, transaction alerts, and the ability to freeze or unfreeze your card instantly through the app. Your account and transactions are protected by these security features.

- Customer Support: Revolut provides customer support through the app, where you can access help articles, FAQs, and contact support if you have any issues or inquiries.

Revolut vs. Qapital

Revolut and Qapital are both financial technology companies that offer digital banking and savings solutions. However, they have different focuses and features.

Here’s a comparison of Revolut and Qapital:

Revolut:

- International Focus: Revolut is known for its international features, including competitive currency exchange rates, international money transfers, and multi-currency accounts. It caters to individuals who frequently travel or make international transactions.

- Banking Services: Revolut provides a wide range of banking services, including currency exchange, money transfers, bill payments, budgeting tools, and spending analytics. It also offers additional features like cryptocurrency trading and premium subscription plans.

- Mobile App Experience: Revolut operates primarily through its user-friendly mobile app, allowing users to manage their finances, make payments, and access various banking services on the go. The app interface is intuitive and offers a seamless user experience.

- Broad Range of Customers: Revolut serves both individuals and businesses, offering different types of accounts to cater to various customer needs.

Qapital:

- Savings and Goal-Oriented Features: Qapital focuses on helping individuals save money and reach their financial goals. It offers features like automated savings rules, round-up savings, and goal-specific savings accounts.

- Behavioral Finance Approach: Qapital incorporates behavioral finance principles to encourage positive financial habits. It uses personalized rules and gamification techniques to motivate users to save and make smarter financial decisions.

- Goal Visualization and Tracking: Qapital provides visualizations and progress tracking tools to help users stay motivated and monitor their savings progress towards their defined goals.

- Integration with Partner Banks: Qapital partners with existing banks to provide its savings features. This means that the funds saved with Qapital are held in FDIC-insured accounts through its partner banks.

Revolut vs. Wealthfront

Revolut and Wealthfront are two different financial services providers that cater to different aspects of personal finance.

Here’s a comparison between Revolut and Wealthfront:

Revolut:

Digital Banking: Revolut offers a range of digital banking services, including currency exchange, international money transfers, bill payments, budgeting tools, and spending analytics. It focuses on providing a convenient and user-friendly mobile app experience for managing finances.

Multi-Currency Accounts: Revolut allows users to hold and manage multiple currencies within a single account, making it useful for international travelers or those who frequently make transactions in different currencies.

Cryptocurrency Support: Revolut offers the ability to buy, sell, and hold cryptocurrencies, providing users with access to the cryptocurrency market directly within the app.

International Focus: Revolut’s services are designed to cater to individuals who frequently travel or engage in international transactions. It offers competitive currency exchange rates and features for cross-border payments.

Wealthfront:

Robo-Advisory and Investing: Wealthfront is primarily focused on investment services and offers robo-advisory solutions. It uses algorithms and automation to create and manage investment portfolios based on individual goals, risk tolerance, and time horizon.

Portfolio Diversification: Wealthfront aims to provide diversified investment portfolios that align with modern portfolio theory. It utilizes a passive investment strategy, primarily through low-cost index funds, to achieve broad market exposure.

Tax Optimization: Wealthfront offers features like tax-loss harvesting and tax-efficient asset allocation to help optimize tax efficiency and potentially reduce tax liabilities for investors.

Financial Planning Tools: Wealthfront provides financial planning tools and resources to help users track progress towards financial goals, plan for retirement, and make informed investment decisions.

FAQ

Here are some frequently asked questions (FAQs) about Revolut:

What is Revolut?

Revolut is a digital banking and financial technology company that provides a range of financial services through its mobile app. It offers features such as currency exchange, international money transfers, budgeting tools, bill payments, and more.

How do I sign up for a Revolut account?

To sign up for a Revolut account, you need to download the Revolut app from the App Store (for iOS) or Google Play Store (for Android). Follow the on-screen instructions to create an account by providing the required information and completing the verification process.

Is Revolut safe and secure?

Revolut takes security seriously and employs measures such as two-factor authentication, transaction notifications, and the ability to freeze or unfreeze your card instantly through the app. Additionally, Revolut is authorized and regulated by the relevant financial authorities in the countries where it operates.

Does Revolut charge fees?

Revolut offers different account types with varying fees and features. There may be fees associated with services like currency exchange, international transfers, ATM withdrawals, and premium subscription plans. It’s important to review the terms and conditions or consult the Revolut website for the specific fees applicable to your account.

Can I use Revolut abroad?

Yes, Revolut can be used abroad. It offers competitive currency exchange rates and allows you to hold and spend in multiple currencies. This makes it convenient for international travelers or individuals who frequently make transactions in different currencies.

Does Revolut offer customer support?

Yes, Revolut provides customer support through the app. You can access help articles, FAQs, and chat with a support agent if you have any questions or issues. The availability and response times may vary based on your location and account type.

Can I get a physical debit card with Revolut?

Yes, Revolut offers physical debit cards that can be used for in-person purchases at retail locations and to withdraw cash from ATMs. You can order a physical card through the app and it will be linked to your Revolut account.

Does Revolut offer insurance or savings features?

Revolut may offer additional features like insurance and savings options depending on your location and account type. These features may include travel insurance, device insurance, and access to savings Vaults or investment options. It’s advisable to check the Revolut app or website for the specific features available in your region.

Technology

PicsArt – Photo Studio for Windows 10

PicsArt Overview

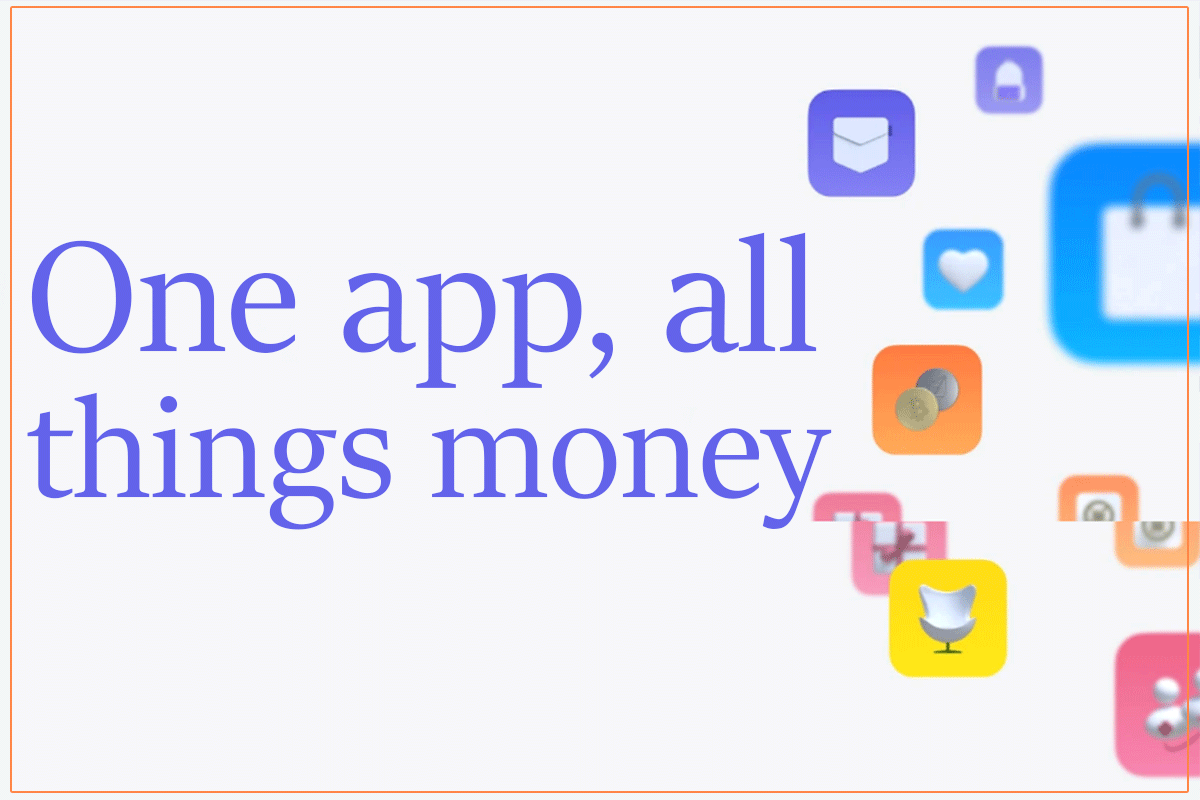

PicsArt is a photo and video editing application that allows users to create, edit, and share visual content. The application is available for both mobile devices and desktop computers and offers a range of features and tools for users to enhance their photos and videos.

The main features of PicsArt include a photo editor, collage maker, video editor, meme generator, and a library of stickers, filters, and effects. The photo editor allows users to adjust various aspects of their photos, such as brightness, contrast, and saturation, and add effects and filters to create a specific look or style.

The collage maker feature allows users to combine multiple photos into a single image, while the video editor allows users to edit and enhance their videos with special effects, music, and text overlays. The meme generator feature allows users to create humorous images with captions, while the library of stickers, filters, and effects provides a wide range of options to add to photos and videos.

PicsArt is popular among social media users, content creators, and digital marketers who want to create visually appealing and engaging content. The application is available in both free and paid versions, with the paid versions providing access to additional features and content.

Overall, PicsArt is a versatile tool that offers a range of features and tools for users to enhance and transform their visual content, making it a great option for anyone looking to create high-quality visual content for personal or professional use.

Photo Studio for Windows 10

PicsArt Photo Studio for Windows 10 is a desktop version of the popular mobile application that allows users to edit photos and videos, create collages, and add stickers, filters, and effects to their content. The desktop version offers additional features and tools, including the ability to work with layers, create vector graphics, and edit RAW files.

The user interface of PicsArt Photo Studio for Windows 10 is similar to the mobile app, making it easy for users to navigate and use. The app also provides access to a range of tutorials and resources to help users learn how to use the different features and tools available.

One of the standout features of PicsArt Photo Studio for Windows 10 is its AI-powered tools, which use artificial intelligence to automatically enhance photos and videos. These tools can help users to quickly and easily improve the quality and appearance of their content without needing to manually adjust settings.

PicsArt Photo Studio for Windows 10 is available for download from the Microsoft Store and is compatible with Windows 10 devices. The app is available in both free and paid versions, with the paid version providing access to additional features and content.

Overall, PicsArt Photo Studio for Windows 10 is a powerful desktop application that offers a range of features and tools for users to enhance and transform their visual content, making it a great option for anyone looking to create high-quality visual content on their desktop computer.

Preemium photo editor and social network

PicsArt is not only a photo editor but also a social network that allows users to share their edited photos and videos with other users. The app has a community of millions of users who share their content, offer feedback, and collaborate on projects.

The premium version of PicsArt, called PicsArt Gold, provides users with additional features and tools to enhance their visual content. These features include advanced editing tools, exclusive filters and effects, and access to premium content.

PicsArt Gold also offers additional benefits on the social network side of the app. For example, users with a Gold subscription can access exclusive stickers and frames, and they can also see insights and analytics about their posts, such as how many people have viewed or interacted with them.

Overall, PicsArt is more than just a photo editor – it’s also a social network that allows users to connect and collaborate with others who share their interests and passions for visual content creation. The premium version of the app, PicsArt Gold, provides even more features and benefits for users who want to take their visual content to the next level.

Create amazing works of art

PicsArt provides users with a range of features and tools to create amazing works of art from their photos and videos. The app offers a variety of editing tools to adjust brightness, contrast, and saturation, as well as to crop, resize, and rotate images.

In addition to basic editing tools, PicsArt also provides a wide range of creative tools, such as filters, effects, and overlays, that can be used to add a specific style or mood to photos and videos. Users can also create their own stickers and add text to their content to make it more engaging and eye-catching.

The app’s collage maker and video editor features also allow users to combine multiple images and videos into a single piece of art. The collage maker feature offers a range of layouts and templates to choose from, while the video editor provides a variety of transitions, effects, and filters to enhance videos.

PicsArt also provides users with a community of other artists and creators who share their work and provide inspiration and feedback. This community is a great resource for users who want to learn new techniques and stay up-to-date on the latest trends in visual content creation.

Overall, PicsArt is a powerful tool for creating amazing works of art from photos and videos. With its wide range of features and tools, along with a supportive community of creators, PicsArt provides users with everything they need to unleash their creativity and make stunning visual content.

The PicsArt download and installation process

To download and install PicsArt, you can follow these steps:

- Go to the official PicsArt website or visit the app store for your device (such as the App Store for iOS devices or Google Play for Android devices).

- Search for PicsArt in the search bar and select the appropriate version for your device.

- Click on the “Download” or “Install” button to begin the download and installation process.

Follow the instructions to complete the installation process. Depending on your device and operating system, you may be asked to grant permissions or agree to terms and conditions before the installation can proceed.

Once the installation process is complete, you can open the PicsArt app and start using its various features and tools to edit photos and videos, create collages, and more. Some features may require additional permissions or in-app purchases to unlock, depending on the version of PicsArt you have installed.

It’s worth noting that some versions of PicsArt, such as the desktop version for Windows 10, may require you to create an account and sign in before you can use the app. However, creating an account is usually a quick and easy process that only requires an email address or social media account to get started.

PicsArt for Windows 10 – how it looks

PicsArt for Windows 10 has a user-friendly interface that is optimized for desktop devices. When you first open the app, you will see a home screen that displays several options for creating and editing visual content.

The home screen includes options for editing photos and videos, creating collages, and accessing the app’s social network. There are also buttons to access the app’s store, settings, and help center.

The editing interface in PicsArt for Windows 10 is similar to the mobile version of the app, with a range of tools and features that can be accessed from a toolbar on the left-hand side of the screen. The editing tools include options for adjusting brightness, contrast, saturation, and other image properties, as well as filters, effects, and overlays.

The collage maker and video editor features are also available in the desktop version of PicsArt and can be accessed from the home screen. The collage maker offers a variety of layout options and templates to choose from, while the video editor provides a range of effects and transitions to enhance your videos.

Overall, PicsArt for Windows 10 offers a robust set of editing tools and features, along with a user-friendly interface that is optimized for desktop devices. Whether you’re a beginner or a seasoned artist, PicsArt for Windows 10 is a great option for creating and editing visual content on your desktop computer.

What kind of edits can you make with PicsArt?

PicsArt offers a wide range of editing tools and features that allow you to make a variety of edits to your photos and videos. Here are some of the edits you can make with PicsArt:

- Adjustments: PicsArt provides tools to adjust brightness, contrast, saturation, hue, and more. You can use these tools to fine-tune the color and tone of your images.

- Filters and effects: PicsArt offers a variety of filters and effects that can be applied to your photos and videos to create different moods and styles. These include retro, vintage, and artistic filters, as well as effects like bokeh, glitch, and lens flare.

- Text and stickers: You can add text and stickers to your photos and videos to make them more engaging and eye-catching. PicsArt offers a range of fonts and stickers to choose from, or you can create your own custom stickers.

- Collages: With PicsArt’s collage maker feature, you can combine multiple images into a single composition. The app offers a variety of layouts and templates to choose from, or you can create your own custom layout.

- Frames and borders: PicsArt allows you to add frames and borders to your images to give them a polished, finished look.

- Drawing and painting: PicsArt includes a drawing and painting tool that allows you to create your own artwork from scratch. You can use a variety of brushes, colors, and textures to create unique digital art.

Overall, PicsArt provides a wide range of editing tools and features that can be used to create a variety of edits and styles. Whether you want to enhance your photos with filters and effects or create custom artwork from scratch, PicsArt has something for everyone.

Is it any good?

Yes, PicsArt is a popular and highly rated photo editing app that offers a wide range of tools and features for both beginners and advanced users. The app has been downloaded millions of times and has a 4.5-star rating on both the App Store and Google Play.

One of the key strengths of PicsArt is its versatility. The app offers a range of tools and features for editing photos, videos, and creating digital art, making it a one-stop-shop for all your creative needs. Whether you’re looking to enhance your photos with filters and effects, create collages, or draw and paint your own artwork, PicsArt has you covered.

Additionally, PicsArt is known for its user-friendly interface, which makes it easy to navigate and use even for beginners. The app also offers a social networking aspect, allowing users to share their creations with a community of like-minded artists and creators.

Overall, if you’re looking for a versatile and user-friendly photo editing app that offers a wide range of tools and features, PicsArt is definitely worth checking out.

PicsArt Pros and cons

Sure, here are some pros and cons of using PicsArt:

Pros:

- Versatile editing tools: PicsArt offers a wide range of editing tools and features, from basic adjustments to advanced editing options. This makes it a great choice for both beginners and more experienced users.

- Extensive collection of filters and effects: PicsArt provides a huge selection of filters and effects that can help you achieve a variety of styles and moods in your photos and videos.

- Collage maker: PicsArt’s collage maker feature allows you to easily combine multiple photos into a single composition. The app offers a range of templates and layouts to choose from, or you can create your own custom layout.

- Drawing and painting tools: PicsArt includes a drawing and painting tool that allows you to create your own artwork from scratch. You can use a variety of brushes, colors, and textures to create unique digital art.

- Social media integration: PicsArt includes a social networking aspect that allows you to share your creations with a community of like-minded artists and creators.

Cons:

- Subscription model: While PicsArt offers a free version of the app, many of the more advanced features and tools require a subscription. This may be a drawback for users who don’t want to pay for a subscription.

- Overwhelming interface: Some users may find PicsArt’s interface overwhelming or confusing, particularly if they are new to photo editing.

- In-app purchases: In addition to the subscription model, PicsArt also includes in-app purchases that can add up quickly if you’re not careful.

- Limited functionality on mobile: While PicsArt offers a mobile app, some of the more advanced editing tools and features are only available on the desktop version.

- Performance issues: Some users may experience performance issues or crashes when using PicsArt, particularly if they are using an older device or have limited memory or storage space.

Technology

Kinguin Review – Is Kinguin Safe, Legit, Or Scam?

Kinguin Overview

Kinguin is an online marketplace for digital products, primarily focusing on video games, software, and in-game items. It operates as a platform where third-party sellers can list their products for sale, and customers can browse and purchase these products.

Here’s an overview of Kinguin’s key features and offerings:

Product Variety: Kinguin offers a wide selection of digital products, including game keys, software licenses, in-game items, gift cards, and more. The platform covers various platforms such as Steam, Origin, Uplay, Xbox, PlayStation, and others.

Third-Party Sellers: Kinguin works with a network of third-party sellers who list their products on the platform. These sellers can be individuals or companies, and they set their own prices for the products they offer.

Competitive Pricing: One of the main advantages of using Kinguin is the potential for finding games and software at lower prices compared to official retail channels. Due to the nature of the marketplace, sellers may offer discounts or promotions, which can result in cost savings for customers.

Buyer Protection: Kinguin provides a Buyer Protection Program that aims to ensure the quality and legitimacy of the products sold on the platform. It includes features such as guarantees for the quality of the products, 24/7 customer support, and the option to request a refund or replacement in case of issues with the purchased items.

Kinguin Plus: Kinguin offers a subscription service called Kinguin Plus. Subscribers gain access to additional benefits, such as exclusive deals, faster customer support response times, and a loyalty program with points that can be redeemed for discounts.

Community Features: Kinguin has community-oriented features, including user reviews and ratings for sellers and products. These can help customers make informed decisions when choosing a seller or purchasing a product.

Kinguin’s Buyers’ Protection

Kinguin offers a Buyers’ Protection Program to provide customers with additional security and assurance when making purchases on their platform. Here are the key features of Kinguin’s Buyers’ Protection:

Quality Guarantee: Kinguin guarantees the quality and functionality of the products purchased on their platform. If there is an issue with the product, such as a non-working key or code, customers can contact Kinguin’s customer support for assistance.

24/7 Customer Support: Kinguin provides customer support around the clock to address any inquiries or concerns that customers may have. If there are any issues with a purchase, customers can reach out to Kinguin’s support team for assistance and resolution.

Refund and Replacement Options: If a purchased product is not as described, invalid, or doesn’t work, customers can request a refund or replacement from Kinguin. This helps protect buyers from potential fraudulent or misrepresented listings.

Dispute Resolution: In the event of a dispute between the buyer and the seller, Kinguin’s customer support acts as a mediator to resolve the issue. They review the case, gather relevant information, and work towards a fair resolution for both parties involved.

Is Kinguin Legit?

Kinguin is a legitimate online marketplace for digital products, including video game keys, software licenses, and in-game items. The platform has been operating since 2013 and has gained popularity among gamers and software enthusiasts.

However, it’s important to note that while Kinguin is a legitimate platform, it operates as a marketplace where third-party sellers list their products for sale. As a result, the reliability and legitimacy of individual sellers may vary.

Kinguin has implemented measures to help ensure the quality and authenticity of products sold on their platform. They offer a Buyers’ Protection Program, which includes guarantees for product quality, 24/7 customer support, and options for refunds or replacements in case of issues with purchased items. They also have user reviews and ratings that can help customers make informed decisions about sellers and products.

That being said, there are some potential risks associated with purchasing from third-party sellers, including the possibility of fraudulent or unauthorized keys. While Kinguin takes steps to prevent such instances, it’s always advisable to exercise caution and read customer reviews, ratings, and seller information before making a purchase.

Is Kinguin Legit For Software And Game Keys?

Kinguin is a well-known online marketplace that offers software and game keys, among other digital products. However, it’s important to note that the legitimacy of the keys sold on Kinguin can vary depending on the individual sellers.

Kinguin operates as a platform where third-party sellers list their products, including software and game keys, for sale. While Kinguin takes measures to ensure the quality and legitimacy of products sold on their platform, there is always a risk of encountering unauthorized or illegitimate keys when purchasing from third-party sellers.

Some sellers on Kinguin acquire keys through legitimate channels, such as authorized distributors or promotional deals. However, there is also a possibility that some sellers may engage in practices that violate the terms and conditions of software developers or publishers, potentially resulting in unauthorized or grey market keys.

It’s important to exercise caution and consider the following when purchasing software or game keys on Kinguin or any other similar platform:

Seller Reputation: Pay attention to seller ratings, reviews, and feedback from previous customers. This can provide insights into the reliability and legitimacy of a particular seller.

Pricing: Be wary of deals that seem too good to be true. Abnormally low prices can be an indication of unauthorized or illegitimate keys.

Buyer Protection: Take advantage of Kinguin’s Buyers’ Protection Program, which provides guarantees, customer support, and refund or replacement options in case of issues with purchased items.

Research: Do thorough research on the specific software or game you intend to purchase and familiarize yourself with the developer’s policies regarding key reselling. Some developers explicitly prohibit or discourage the use of unauthorized or grey market keys.

Is Kinguin Scam?

Kinguin itself is not a scam as it is a legitimate online marketplace that connects buyers and sellers of digital products, including software and game keys. However, it’s important to be aware that there are risks associated with purchasing from third-party sellers on Kinguin.

The reliability and legitimacy of individual sellers on Kinguin can vary. While Kinguin takes measures to ensure the quality and authenticity of products sold on their platform, there is still a possibility of encountering unauthorized or illegitimate keys when purchasing from certain sellers.

Some potential risks to consider when using Kinguin or similar marketplaces include:

Illegitimate Keys: There is a chance of purchasing unauthorized or grey market keys from sellers on Kinguin. These keys may have been acquired through unauthorized means, such as key generators or reselling keys obtained from promotional giveaways or bundles.

Regional Restrictions: Certain software or game keys sold on Kinguin may have regional restrictions, meaning they may only be valid for activation and use in specific countries or regions. It’s essential to carefully read the product descriptions and ensure that the key you are purchasing is valid for your region.

Fraudulent Sellers: While Kinguin attempts to verify the legitimacy of sellers, fraudulent sellers can still exist. It’s important to research sellers, read customer reviews, and exercise caution before making a purchase.

To minimize the risks, consider the following precautions:

Check Seller Ratings and Reviews: Take the time to read reviews and ratings for the seller you are considering purchasing from. This can provide insights into the reputation and reliability of the seller.

Use Buyer Protection: Utilize Kinguin’s Buyers’ Protection Program, which offers guarantees, customer support, and refund or replacement options in case of issues with purchased items.

Research and Understand Policies: Familiarize yourself with the policies and terms of the software developers or publishers regarding key reselling. This can help you make informed decisions and avoid violating any terms of service.

Is Kinguin Safe And Secure?

The safety and security of using Kinguin can vary depending on several factors. While Kinguin is a legitimate online marketplace that has been operating for several years, it’s important to consider certain aspects when assessing its safety and security:

Legitimacy of Sellers: Kinguin operates as a platform where third-party sellers list their products for sale. The legitimacy and reliability of individual sellers can vary. While Kinguin takes measures to verify sellers and the quality of their products, there is still a possibility of encountering unauthorized or illegitimate keys from certain sellers. It’s important to research sellers, read reviews, and consider their reputation before making a purchase.

Buyers’ Protection Program: Kinguin offers a Buyers’ Protection Program that includes guarantees for product quality, 24/7 customer support, and options for refunds or replacements in case of issues with purchased items. Utilizing this program can provide an additional layer of security and assistance if problems arise with a purchase.

Regional Restrictions: Some software or game keys sold on Kinguin may have regional restrictions, meaning they may only be valid for activation and use in specific countries or regions. It’s essential to carefully read the product descriptions and ensure that the key you are purchasing is valid for your region.

Ethical Considerations: The use of grey market platforms like Kinguin raises ethical considerations. Game developers and publishers often have policies against the resale of keys obtained from unauthorized sources. It’s important to be aware of these policies and make informed decisions as a consumer.

User Precautions: As with any online marketplace, it’s important for users to take precautions to protect their personal and financial information. Use secure payment methods, ensure the website connection is encrypted (look for “https” in the URL), and exercise caution when sharing sensitive data.

What You Can Buy On Kinguin?

On Kinguin, you can buy a variety of digital products, primarily focused on video games, software, and in-game items. Here are some of the main categories of products available on Kinguin:

Game Keys: Kinguin offers a wide selection of game keys for various platforms, including PC, Xbox, PlayStation, Nintendo, and more. These keys allow you to activate and download games from official platforms like Steam, Origin, Uplay, and others.

Software Licenses: Kinguin also provides software licenses for a range of popular software programs. This includes operating systems, productivity software, graphic design tools, antivirus programs, and more.

In-Game Items and Skins: If you’re an avid gamer, Kinguin offers in-game items, virtual currency, and cosmetic skins for various popular games. These items can enhance your gaming experience or allow you to customize your characters or gameplay.

Gift Cards and Prepaid Cards: Kinguin provides digital gift cards and prepaid cards for popular platforms and services, such as Steam, Xbox Live, PlayStation Network, and more. These cards allow you to add funds to your accounts or purchase games and other content.

Game Subscriptions: Some game subscriptions, such as Xbox Game Pass or PlayStation Plus, may be available for purchase on Kinguin. These subscriptions grant you access to a library of games or provide additional benefits and features.

FAQ

Here are some frequently asked questions (FAQs) about Kinguin:

Is Kinguin a legitimate website?

Yes, Kinguin is a legitimate online marketplace that connects buyers and sellers of digital products.

How does Kinguin work?

Kinguin operates as a platform where third-party sellers list their digital products, including game keys, software licenses, and in-game items. Buyers can browse the listings, make purchases, and receive the product keys or digital items.

How can I create an account on Kinguin?

To create an account on Kinguin, visit their website and click on the “Register” or “Sign Up” button. You’ll need to provide your email address, choose a password, and agree to the terms and conditions.

What payment methods are accepted on Kinguin?

Kinguin accepts a variety of payment methods, including credit/debit cards, PayPal, Skrill, paysafecard, and more. The available payment options may vary depending on your location.

What is Kinguin Buyer Protection?

Kinguin Buyer Protection is a program that offers additional security and guarantees for buyers. It provides assistance and options for refunds or replacements if there are issues with purchased products.

How do I activate a game key or software license from Kinguin?

The activation process can vary depending on the specific product and platform. Generally, you’ll receive a product key that needs to be entered or redeemed on the appropriate platform, such as Steam, Uplay, or others. Detailed instructions are typically provided with the product.What is the refund policy on Kinguin?

Kinguin has a refund policy in place, but the specifics may depend on the individual seller and the product purchased. It’s recommended to review the product listing and contact Kinguin customer support for assistance with refunds or returns.

How can I contact Kinguin customer support?

You can contact Kinguin customer support by visiting their website and clicking on the “Support” or “Contact Us” section. They typically provide options for live chat, email, or submitting a support ticket.

Bottom Line

Kinguin is a legitimate online marketplace that connects buyers and sellers of digital products, including game keys, software licenses, and in-game items. However, there are risks associated with purchasing from third-party sellers, such as the potential for unauthorized or illegitimate keys. Kinguin offers buyer protection programs and guarantees to help mitigate these risks. It’s important for users to research sellers, read reviews, and make informed decisions before making a purchase. Additionally, users should be aware of any regional restrictions and ethical considerations associated with grey market platforms.

Technology

Revolut Review – Is it the best way to take money abroad in 2023?

About Revolut

Revolut is a financial technology company that provides a range of digital banking services and financial products. Here are some key points about Revolut:

- Overview: Revolut was founded in 2015 and is headquartered in London, United Kingdom. It started as a mobile app that offered a prepaid debit card and currency exchange services. Since then, it has expanded its services and gained popularity globally.

- Mobile Banking App: Revolut operates primarily through its mobile banking app, available for both iOS and Android devices. The app provides users with access to a variety of financial services, including spending and budgeting tools, international money transfers, currency exchange, and investment options.

- Multi-Currency Accounts: One of Revolut’s main features is its multi-currency accounts. Users can hold and manage multiple currencies within their Revolut account, allowing for convenient currency exchange at competitive rates when traveling or making international payments.

- International Money Transfers: Revolut enables users to send and receive money internationally with competitive exchange rates and low fees. It supports transfers in various currencies and offers features like real-time exchange rates and peer-to-peer transfers.

- Debit Card and Payment Services: Revolut provides users with a physical or virtual debit card linked to their account. This card can be used for making purchases, withdrawing cash from ATMs, and accessing other payment services. The app also offers features like spending analytics, budgeting tools, and card security controls.

- Additional Services: Revolut has expanded its offerings to include various additional services, such as cryptocurrency trading, stock trading, savings accounts, insurance, and business accounts. These services provide users with more options to manage their finances and investments.

- Fees and Pricing: Revolut offers different account tiers with varying features and pricing structures. While some basic features are available for free, premium features and services may require a subscription fee or transaction fees. It’s important to review the specific terms and conditions, as well as any associated fees, before using Revolut’s services.

- Regulation and Security: Revolut is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom and operates under e-money licenses in different regions. The company implements security measures to protect user data and transactions, including two-factor authentication and transaction notifications.

How does Revolut work?

Revolut works as a digital banking platform that provides users with a range of financial services through its mobile app. Here’s an overview of how Revolut works:

- Account Creation: Users can download the Revolut app on their iOS or Android device and sign up for an account. The registration process typically involves providing personal information, verifying identity, and creating a secure login.

- Account Funding: Once the account is created, users can fund their Revolut account by linking it to their existing bank account or by transferring money from another source. Revolut supports multiple currencies, allowing users to hold and manage different currencies within their account.

- Currency Exchange: One of the key features of Revolut is its currency exchange capabilities. Users can exchange currencies within the app at competitive rates, enabling them to manage and convert funds between different currencies easily. The app provides real-time exchange rates and supports a wide range of currencies.

- Debit Card and Payments: Revolut issues physical and virtual debit cards that are linked to the user’s account. These cards can be used for making purchases online and in-store, as well as for cash withdrawals at ATMs. The app also supports various payment options, including contactless payments, QR code scanning, and peer-to-peer transfers.

- International Money Transfers: Revolut allows users to send and receive money internationally. Users can initiate international transfers within the app, taking advantage of competitive exchange rates and low fees. The app provides transparency on fees and real-time updates on the progress of the transfer.

- Additional Services: Revolut offers additional services to its users, including cryptocurrency trading, stock trading, savings accounts, insurance, and business accounts. These services provide users with more options to manage their finances and investments within the app.

- Budgeting and Analytics: The Revolut app provides users with tools for managing their finances, including spending analytics, budgeting features, and transaction categorization. Users can set spending limits, receive notifications on their expenses, and gain insights into their financial habits.

- Security and Safety: Revolut takes security seriously and implements measures to protect user data and transactions. This includes two-factor authentication, transaction notifications, and the ability to lock or freeze cards within the app if they are lost or stolen.

Revolut Key features

Revolut offers several key features that distinguish it as a digital banking platform. Here are some of the key features of Revolut:

- Multi-Currency Accounts: Revolut allows users to hold and manage multiple currencies within their account. This feature is particularly useful for international travelers or individuals who frequently make transactions in different currencies. Users can exchange currencies within the app at competitive rates.

- Currency Exchange: Revolut offers real-time currency exchange at interbank rates for over 150 currencies. Users can exchange currencies instantly within the app, saving on traditional bank fees and avoiding unfavorable exchange rates. The app provides real-time exchange rate alerts and supports auto-exchange and recurring payments.

- International Money Transfers: Revolut enables users to send and receive money internationally with competitive exchange rates and low fees. Users can make international transfers directly within the app, avoiding traditional banking intermediaries. Transfers can be initiated in multiple currencies, and the app provides real-time updates on the progress of the transfer.

- Debit Card and Contactless Payments: Revolut issues physical and virtual debit cards that are linked to the user’s account. These cards can be used for making purchases online and in-store, as well as for cash withdrawals at ATMs. The cards support contactless payments, and users can easily manage their card settings within the app.

- Budgeting and Analytics: Revolut provides tools for users to manage their finances effectively. The app categorizes transactions, provides spending analytics, and offers budgeting features. Users can set spending limits, receive notifications on their expenses, and gain insights into their financial habits.

- Cryptocurrency Support: Revolut allows users to buy, sell, and hold popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The app provides real-time cryptocurrency exchange rates and supports easy conversion between cryptocurrencies and traditional currencies.

- Savings Vaults: Revolut offers Savings Vaults, which are digital savings accounts that allow users to set aside money for specific goals or purposes. Users can round up their transactions and save the spare change automatically or make manual transfers to their Savings Vaults.

- Business Accounts: In addition to personal accounts, Revolut offers business accounts tailored to the needs of freelancers, entrepreneurs, and small businesses. These accounts provide features such as multi-currency transactions, expense management, and integration with popular accounting software.

Revolut plans

Revolut offers different account plans to cater to varying needs and preferences of its users. The specific plans and features may vary depending on the user’s location. Here are some common account plans offered by Revolut:

Standard: This is the basic account plan offered by Revolut and is typically free of charge. It provides users with a range of essential features, including a multi-currency account, free currency exchange at interbank rates, and a physical or virtual debit card. The Standard plan may have certain transaction limits and charges for certain premium features.

Premium: The Premium plan is a subscription-based account plan that offers additional features and benefits. It usually comes with a monthly or annual fee. The Premium plan typically includes features such as higher ATM withdrawal limits, overseas medical insurance, and exclusive customer support. Users subscribed to the Premium plan may also have access to additional perks and discounts.

Metal: The Metal plan is the top-tier subscription plan offered by Revolut. It offers all the features of the Premium plan and adds further benefits. These benefits often include higher withdrawal limits, cashback on card purchases, exclusive concierge service, and additional travel-related perks. The Metal plan often comes with a higher monthly or annual fee compared to the other plans.

Is Revolut a bank?

Revolut is not a traditional bank in the sense that it is not a licensed bank. However, it operates as a financial technology company that offers banking services and products. Here are some important points regarding Revolut’s status:

E-Money Institution: Revolut is authorized and regulated as an Electronic Money Institution (EMI) by the Financial Conduct Authority (FCA) in the United Kingdom. As an EMI, Revolut is allowed to issue electronic money, provide payment services, and offer certain banking-related functionalities.

Banking Services: Revolut provides many services typically associated with traditional banks, including multi-currency accounts, currency exchange, debit cards, international money transfers, and various financial management tools. These services are delivered through their mobile app.

Deposit Protection: It’s important to note that funds held in a Revolut account are not covered by traditional deposit protection schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK. However, Revolut has implemented safeguards to protect client funds, including segregated accounts with tier-one banks and strong security measures.

Partnerships with Licensed Banks: Revolut has partnered with licensed banks in different regions to provide certain banking services. For example, in the European Economic Area (EEA), Revolut operates under an e-money license and partners with licensed banks to hold customers’ funds and provide banking services.

Expansion and Licenses: Revolut has been expanding its services globally and obtaining licenses in various jurisdictions. In some regions, such as Australia and Singapore, Revolut has obtained licenses to operate as a regulated entity.

How much does Revolut cost?

The cost of using Revolut can vary depending on the specific plan and services you choose. Revolut offers different account plans, each with its own features and pricing. Here’s an overview of the typical costs associated with Revolut:

Standard Account: The Standard account is the basic account plan offered by Revolut and is usually free of charge. It provides essential features like a multi-currency account, currency exchange, and a physical or virtual debit card. While the Standard account is generally free, there may be fees associated with certain premium features or services.

Premium Account: The Premium account is a subscription-based plan that offers additional features and benefits. The Premium account typically comes with a monthly or annual fee. The pricing for the Premium account varies depending on the user’s location and may range from a few dollars or euros per month to a higher annual fee. The exact cost can be found on the official Revolut website or by contacting their customer support.

Metal Account: The Metal account is the top-tier subscription plan offered by Revolut. It includes all the features of the Premium account and provides additional benefits such as higher withdrawal limits, cashback on card purchases, and exclusive customer support. The Metal account usually comes with a higher monthly or annual fee compared to the other plans. The exact pricing can be found on the Revolut website or by contacting their customer support.

Can you use Revolut abroad?

Yes, you can use Revolut abroad. One of the key advantages of Revolut is its international functionality and the ability to use it while traveling. Here are some important points to know about using Revolut abroad:

- Multi-Currency Accounts: Revolut allows you to hold and manage multiple currencies within your account. This feature is particularly beneficial for international travel as it allows you to exchange currencies at competitive rates and hold funds in different currencies. You can switch between currencies within the app and spend in the local currency when you’re abroad.

- Currency Exchange: Revolut offers real-time currency exchange at interbank rates for over 150 currencies. This means you can exchange currencies within the app while you’re abroad, avoiding high fees and unfavorable exchange rates typically associated with traditional banks or currency exchange services.

- Debit Card Usage: Revolut issues physical and virtual debit cards that are linked to your account. You can use these cards while traveling abroad to make purchases at retail stores, restaurants, and online merchants that accept Mastercard or Visa. The transactions will be processed in the local currency, and you can enjoy the convenience and security of using a debit card.

- ATM Withdrawals: With your Revolut card, you can withdraw cash from ATMs while traveling abroad. Revolut often offers fee-free ATM withdrawals up to a certain limit, depending on your account plan. However, it’s important to note that some ATMs or local banks may charge their own fees, which are not controlled by Revolut.

- Spending Analytics and Budgeting: Revolut provides features to help you manage your expenses while abroad. The app categorizes your transactions, provides spending analytics, and offers budgeting tools. This can be useful for tracking your expenses and staying within your budget while traveling.

Alternatives to Revolut

There are several alternatives to Revolut that offer similar digital banking services. Here are a few popular options:

- TransferWise (now known as Wise): Wise offers international money transfers at competitive rates, multi-currency accounts, and a debit card. It’s known for its transparency in fees and exchange rates.

- N26: N26 is a mobile banking platform that provides multi-currency accounts, debit cards, and features for budgeting and expense tracking. It offers a seamless mobile banking experience with a focus on simplicity and user-friendly interfaces.

- Monzo: Monzo is a digital bank that offers a range of banking services, including multi-currency accounts, debit cards, and budgeting tools. It’s known for its user-friendly app and customer-centric approach.

- Starling Bank: Starling Bank is a UK-based digital bank that provides features like mobile banking, multi-currency accounts, and budgeting tools. It offers a wide range of banking services with a focus on customer experience.

- Revolut’s competitors in specific regions: Depending on your location, there may be local digital banks or fintech companies that offer similar services to Revolut. For example, in the United States, Chime and Varo Money are popular alternatives.

Conclusion

Revolut is a digital banking platform that offers a range of features and services, including multi-currency accounts, currency exchange, international money transfers, and budgeting tools. It aims to provide convenient and cost-effective solutions for individuals who frequently travel internationally or need flexible banking services.

While Revolut has gained popularity for its innovative approach and user-friendly app, customer reviews have been mixed, with both positive and negative feedback. Positive reviews often highlight the convenience and competitive rates offered by Revolut, while negative reviews often mention issues with customer support or occasional account freezes.

-

Marketing4 years ago

Marketing4 years agoConstant Contact Review (Effective Email Marketing Software)

-

Technology4 years ago

Technology4 years agoConstant Contact Info

-

e commerce3 years ago

e commerce3 years agoREI Summer Sale: Upto 50% OFF

-

Technology5 years ago

Technology5 years agoReview On The Themeforest 2020

-

Technology4 years ago

Technology4 years agoHubspot Review- Inbound Marketing, Sales, and Service Software

-

Technology5 years ago

Technology5 years agoWix Review 2022

-

Technology5 years ago

Technology5 years agoBluehost Review 2020

-

e commerce3 years ago

e commerce3 years agoREI 4th of July Sale: Save Up to 50% on Outdoor Gear and Apparel